Filing Income Tax Returns (ITR) is one of the most important responsibilities for taxpayers in India. Every year, millions of individuals and businesses submit their tax returns within the prescribed dates announced by the Income Tax Department. The ITR filing deadline for 2025 is significant because it helps taxpayers avoid penalties, late fees, and unnecessary notices from the authorities.

With changes in tax policies, digital filing systems, and compliance requirements, taxpayers must remain updated about the upcoming deadlines, applicable forms, and rules that will govern the financial year 2024–25.

What is itr filing deadline?

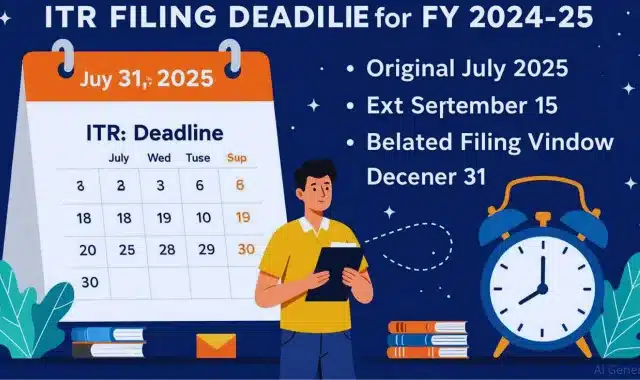

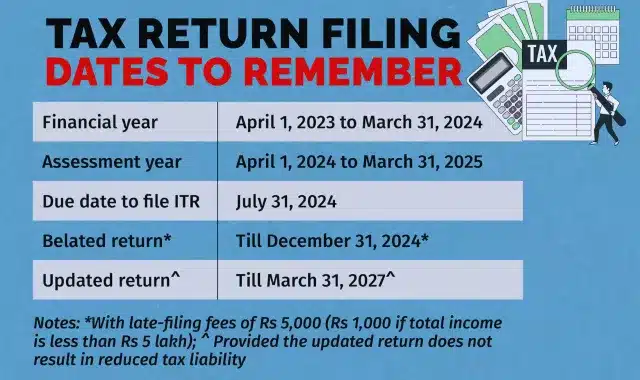

The ITR filing deadline is the last date set by the Income Tax Department for taxpayers to submit their Income Tax Returns for a financial year. Filing before the deadline helps avoid penalties, ensures timely refunds, and maintains compliance. For the assessment year 2025–26, salaried individuals must file their returns by July 31, 2025.

ITR Filing Deadline 2025 At a Glance

| Category of Taxpayer | ITR Filing Deadline 2025 | Notes |

| Individuals (Non-Audit Cases) | July 31, 2025 | Applies to salaried employees and individuals not requiring an audit. |

| Businesses (Audit Required) | October 31, 2025 | Companies and firms need statutory audits. |

| Transfer Pricing Cases | November 30, 2025 | Entities involved in international or specified domestic transactions. |

| Belated/ Revised Returns | December 31, 2025 | Final date to submit corrected or late returns with penalties. |

Why the ITR Filing Deadline 2025 Matters

The income tax system in India has become more structured and technology-driven in recent years. The ITR filing deadline for 2025 is not just a compliance date; it also determines whether taxpayers can avoid penalties, claim refunds on time, and maintain a clean financial record. Missing the deadline can lead to late filing fees under Section 234F, interest on pending dues, and even disqualification from carrying forward certain losses.

Timely filing ensures that individuals get access to faster processing of refunds, eligibility for loans, and a record of financial discipline. For businesses, meeting deadlines is even more critical, as it impacts audits, GST reconciliations, and investor confidence.

itr filing deadline extension

The ITR filing deadline extension refers to the additional time granted by the Income Tax Department for taxpayers to submit their returns beyond the original due date. Extensions are usually announced in special cases, such as technical issues or exceptional circumstances. If granted in 2025, it will provide taxpayers extra time to file without facing penalties.

ITR Filing for Different Categories of Taxpayers

Salaried Individuals: For salaried employees, ITR filing is usually straightforward. They need Form 16 from their employer, details of other income, and proofs of deductions to file ITR-1 or ITR-2. The last date for filing without audit requirements is July 31, 2025.

Business Professionals: Business owners and self-employed professionals with turnover beyond prescribed limits may need an audit of their accounts. Their deadline is extended until October 31, 2025. They generally file ITR-3 or ITR-4, depending on their income type.

Companies: Companies are required to file returns using ITR-6. For them, the deadline for AY 2025-26 is also October 31, 2025, if they are subject to audit. Those engaged in international transactions fall under transfer pricing rules, pushing their deadline to November 30, 2025.

Belated and Revised Returns: If someone misses the July deadline, they can still file a belated return up to December 31, 2025, but with penalties. Similarly, if any mistakes are found in the original filing, a revised return can be filed by the same date.

Penalties for Missing the ITR Filing Deadline 2025

Missing the deadline can have severe consequences. As per Section 234F of the Income Tax Act, a late fee of up to ₹5,000 may be charged. For individuals with income below ₹5 lakh, the penalty is capped at ₹1,000. Additionally, interest under Section 234A may be levied for delayed tax payments. Losses from business or capital gains also cannot be carried forward if returns are not filed on time.

Documents Required for Filing ITR in 2025

To avoid last-minute hassles, taxpayers should keep the following documents ready before filing:

- Form 16 for salaried employees

- Form 26AS and AIS (Annual Information Statement)

- Bank account statements

- TDS certificates

- Proof of deductions (80C, 80D, etc.)

- Capital gains statements

- Aadhaar and PAN details

Having all documents ready ensures error-free filing and faster refund processing.

Steps to File ITR Online in 2025

- Visit the Income Tax e-Filing portal.

- Log in using PAN/Aadhaar and password.

- Select the appropriate ITR form.

- Enter personal, income, and deduction details.

- Verify TDS and tax payment details with Form 26AS.

- Compute tax liability and refund status.

- Submit the form and verify using Aadhaar OTP, net banking, or DSC.

ITR Filing 2025 Key Changes to Expect

Every financial year, the Income Tax Department introduces new provisions or amendments. In 2025, taxpayers may see changes related to:

- Updated tax slabs under the new regime

- Simplified compliance for small businesses

- More integration between GST and ITR portals

- Enhanced digital verification methods

- Expansion of AIS for better transparency

Refunds and Processing Timeline

Once ITR is filed, refunds (if applicable) are usually processed within 30–45 days of verification. Timely filing by the ITR filing deadline 2025 ensures faster refunds, while late filers may experience delays. Refunds are directly credited to the taxpayer’s bank account, making it crucial to link PAN with Aadhaar and update bank details.

Tips to Avoid Missing the ITR Filing Deadline 2025

- Start preparing documents early.

- Use the pre-filled forms on the portal.

- Double-check the bank account and PAN-Aadhaar linkage.

- Consult a CA if income sources are complex.

- Avoid waiting until the last day to file.

Conclusion

The ITR filing deadline 2025 is a critical date for every taxpayer in India. From salaried individuals to businesses, timely compliance ensures smooth financial management, avoidance of penalties, and faster refunds. With technological advancements, filing ITR online has become simpler than ever.

Taxpayers should remain proactive, gather necessary documents, and file before the due dates to ensure peace of mind and financial discipline. By staying informed and filing on time, taxpayers not only meet their legal obligations but also build a strong financial record for the future.

FAQs

Q1. What is the ITR filing deadline for 2025 for salaried individuals?

Ans: The deadline for salaried individuals who do not require audits is July 31, 2025. Filing before this date avoids penalties and ensures timely refunds.

Q2. Can I still file after the ITR filing deadline of 2025?

Ans: Yes, taxpayers can file belated returns until December 31, 2025, but they must pay penalties and may lose the benefit of carrying forward losses.

Q3. What happens if I miss the ITR filing deadline in 2025?

Ans: Missing the deadline attracts a penalty under Section 234F and interest under Section 234A. Additionally, certain financial benefits like carry-forward of losses are lost.

Q4. Which ITR form should I use for filing in 2025?

Ans: The form depends on your income source: ITR-1 for salaried, ITR-2 for multiple income heads, ITR-3 for professionals/businesses, and ITR-4 for presumptive taxation.

Q5. Is Aadhaar mandatory for filing ITR in 2025?

Ans: Yes, linking PAN with Aadhaar remains mandatory for filing returns. Without Aadhaar linkage, the system may reject your ITR filing.